34+ Ira withdrawal tax calculator 2021

Use this tool to. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

Tax Implications For Canadians Working Abroad Overseas Outside Canada

Unfortunately there are limits to how much you can save in an IRA.

. This 20000 exemption is applied against the cumulative distributions from a private employer retirement plan a 401 k plan 457 plan or 403 b plan or other traditional. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Up from 140000 in 2021 for.

Expected Retirement Age This is the age at which you plan to retire. The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life expectancy. How It Works.

On March 27 2020 the CARES Act that was signed into law suspends required minimum distributions RMDS for 2020. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. May not be combined with other offers.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. If you are under. Posted on November 29 2021 by.

Ira withdrawal tax calculator 2021. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Discover Helpful Information And Resources On Taxes From AARP.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Estimate your tax withholding with the new Form W-4P. 34 Ira withdrawal tax calculator 2021 Minggu 04 September 2022 Edit.

You have nonresident alien status. The amount changes each. For a Traditional IRA you can contribute up to 6000 for the tax year 2021 and 6000 for the tax year 2022 or up to 100 of earned income whichever is less.

Regardless of your age you will need to file a Form 1040 and. See how your refund take-home pay or tax due are affected by withholding amount. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Withdrawing money from a qualified retirement account such as a 457 plan can.

Kia steering wheel lock. While long-term savings in a Roth IRA may produce better after-tax returns a. The changes became effective July 1 2002.

Ira withdrawal tax calculator 2021 The. Currently you can save 6000 a yearor 7000 if youre 50 or older. Amount You Expected to Withdraw This is the budgeted.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. Estimated Nonresident Tax Calculator - Tax Year 2021 Use this calculator if you are a nonresident.

Estimate your federal income tax withholding. 2021 IRA Minimum Distribution Tables When owners of a Traditional IRA reach age 72 they are required to take annual minimum distributions. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for.

Retirement Withdrawal Calculator Terms and Definitions. Use this worksheet for 2021. Individuals age 50 and over can.

How To Do My Financial Planning Quora

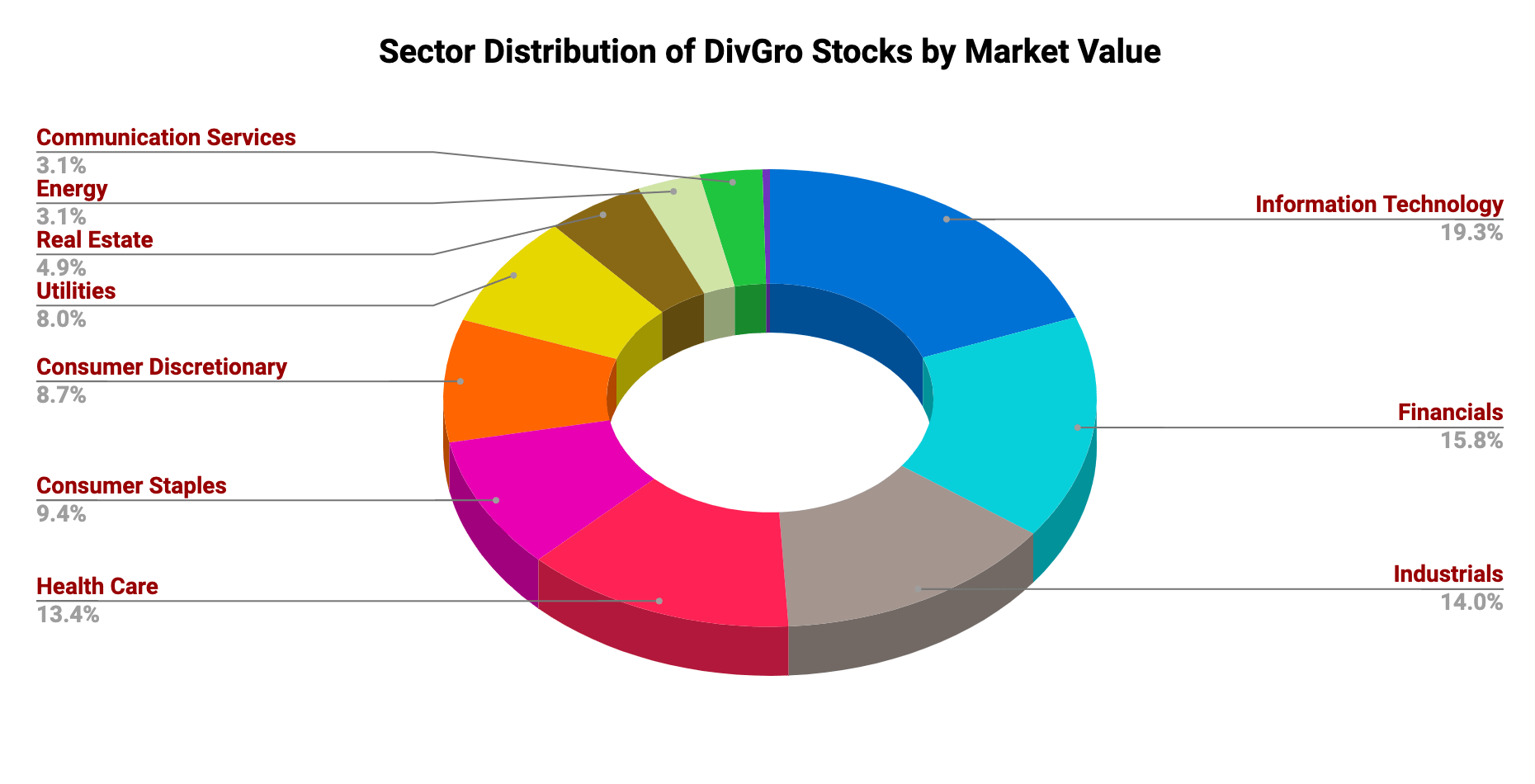

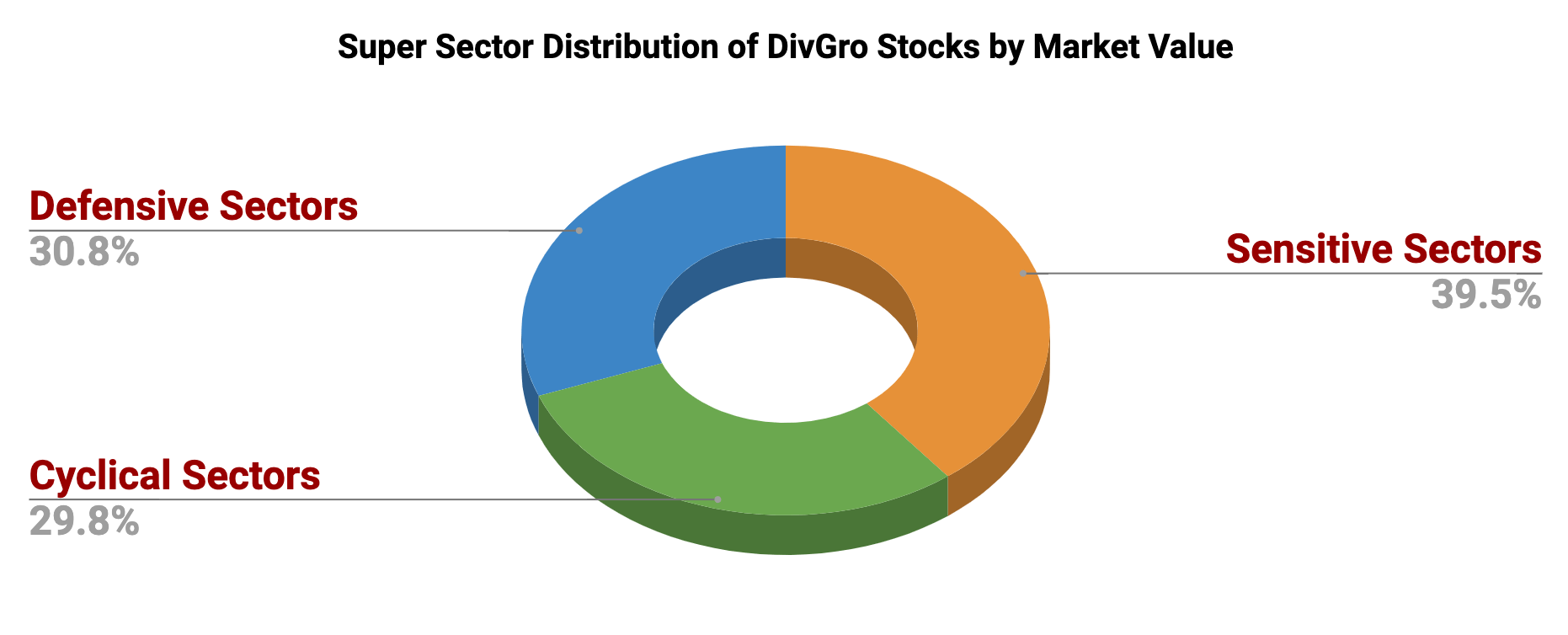

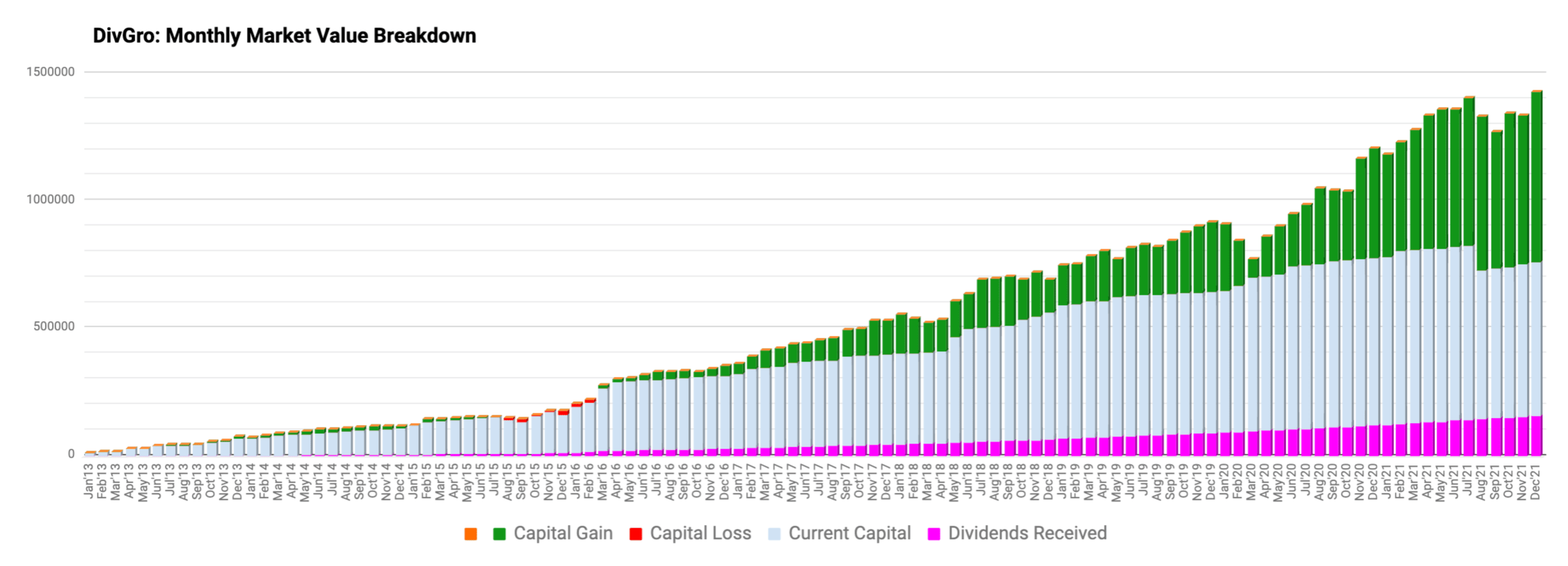

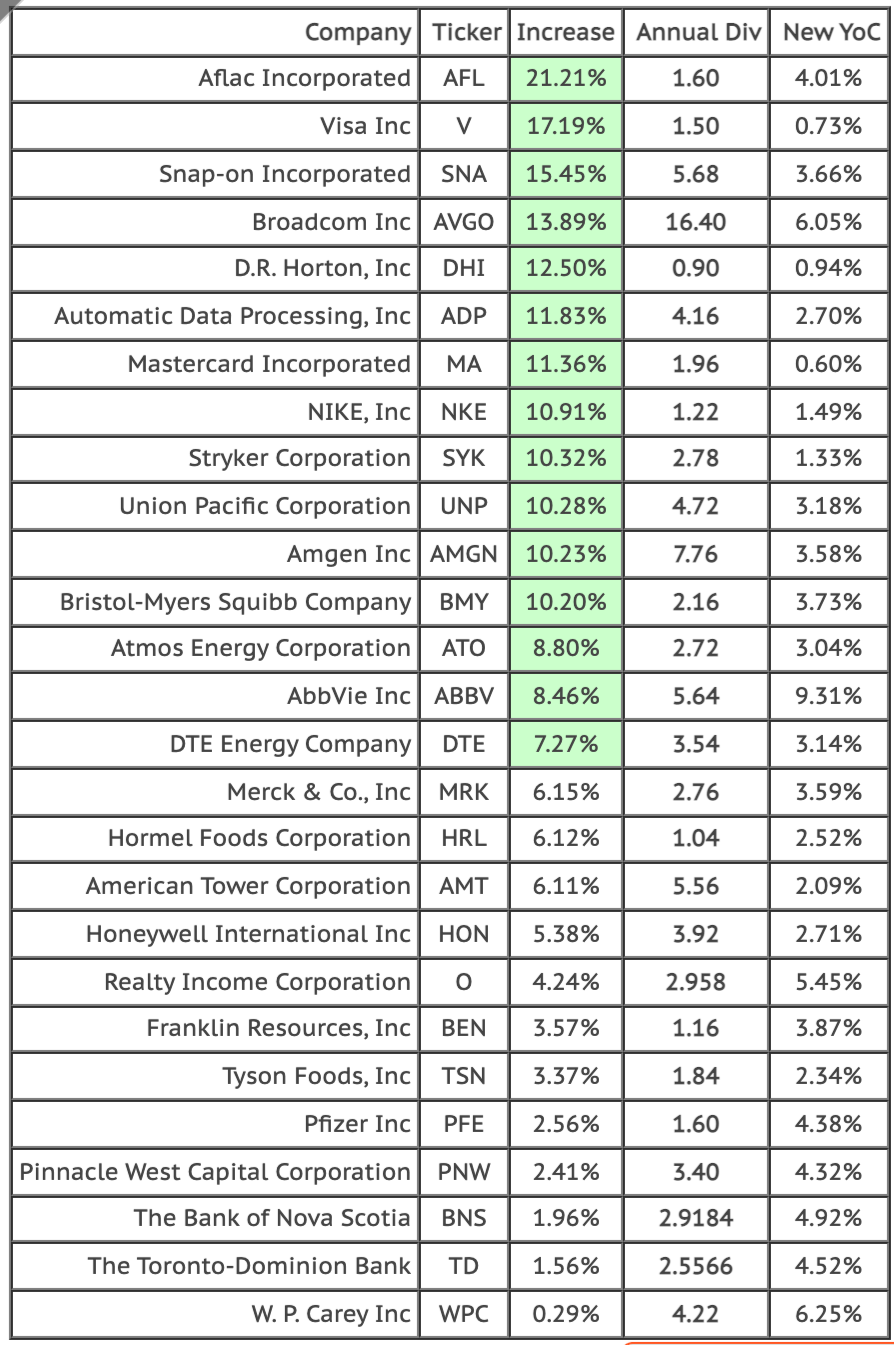

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Tax Implications For Canadians Working Abroad Overseas Outside Canada

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

How A Speeding Ticket Impacts Your Insurance In North Carolina Bankrate

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

2

How To Do My Financial Planning Quora

What Is Involved In Financial Planning Quora

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

My Age Is 34 My Monthly Take Home Is 60k What Will Be The Best Financial Planning For Me Quora

How A Speeding Ticket Impacts Your Insurance In Illinois Bankrate

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Is The 7prosper Annual Financial Plan Worth It Quora